Once you provide your net banking credentials, the page will automatically take you to the portal. It also lets users log in with their net banking method with a preferred bank. To start the process, log in on the income tax portal with credentials like PAN, AADHAAR or user ID and password. Open a web browser on your laptop and go to the e-Filing portal page i.e. Step 2: Visit the official income tax portal All you have to do is to click here to download the tool, fill out the form, and get it ready in ‘.json’ format.ĪLSO READ: Digital Voter Card: Here’s how to download a digital copy of your voter ID card online The Income Tax Department allows taxpayers to fill in the ITR-related details through an offline tool. Step 1: Download the ITR form to fill it offline All you need to do is follow these steps. Here is a step-by-step guide to direct you to the process of filing income tax returns online.

ITR 1, ITR 2, ITR 3, and ITR 4 definition.Following this simple guide, you will be able to file your income tax return easily.

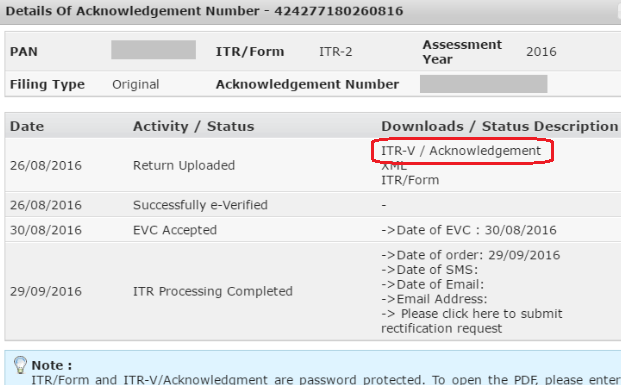

If you are the one who is still stuck in the middle of nowhere, we have got you covered. However, if you are filing your return for the first time you will find it tough to navigate through the official website of the Income Tax department. Over a period of time, the Income tax department has simplified the IT returns filing process for individual taxpayers. It needs great attention to file annual income tax returns and this time, the last date for filing the ITR for the fiscal year 2021-22 is July 31.

0 kommentar(er)

0 kommentar(er)